2011ish.

There's 500 Billion dollars in Option ARM mortgages out there (peers from Portland, OR to Portland, ME.) These are mortgages that allow the holder, for awhile, to pay less than interest owed on the loan each month (That's the option). The deficit amount is added to the loan total. Of these Option ARM mortgages, apparently 80% of the holders are paying the least amount possible. At some point, they will be expected to actually make a real payment; this is called the reset, and often will double the mortgage payment required. When these loans reset, some huge percent of these mortgage holders will be unable to pay the higher amount; the houses will go on the market, or, most likely, into foreclosure, increasing supply and driving housing prices further down.

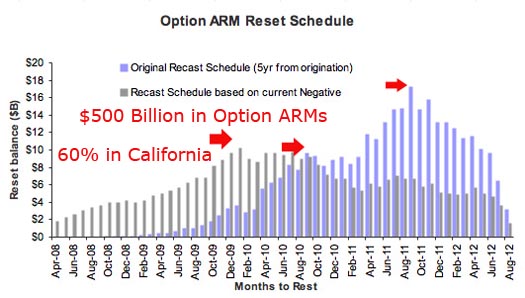

The default reset is 5 years after the mortgage was made. Assuming the height of the housing bubble was January 2005, then the resets should start fast and furious in about 2010.

The handy chart, above, shows when Option Arm loans will be resetting; as you can see, this is far from over.

Dr Housing Bubble Explains it All, Much Better Than Me. I borrowed his chart, thanks.

4 comments:

That was very interesting. Should be a twist if they just pull their access to discount rate funds to push the speculation bubble.

That's what the (those, uh, rich folks, i.e., investment bankers, high level consultants do. It's all about the upside of leverage--tell everyone oil/housing/tulip bulbs are going up (for a fee, of course) while buying them cheapish, watching the price rise, then, timing the sell.... Of course, there's always the probem (Bear Stearns, cough, cough) of beieving your own hype.

This will continue PAST 2011. They are STILL selling ARM mortgages. When applying for my mortgage THIS month, an ARM would have been an option. Are they more stringent with who gets them, I imagine, but you will still hear about people with ARMs past 2011.

Really? Aaaargh. Then we can assume that some giganto percentage of those houses will be in foreclosure in 5 years--mortgage payments double, housing prices haven't gone up, or have gone down, so the house can't be sold.... Man, short financials.

Post a Comment